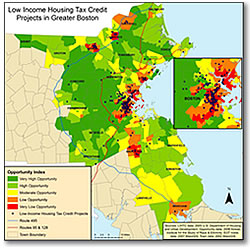

1986: Low-Income Housing Tax Credit (LIHTC)

Although the LIHTC program objectives are to create mixed income and racially integrated communities, the result of the LIHTC is to concentrate housing projects in communities of color with high poverty rates rather than in areas of “higher opportunity.”

In High-Poverty Areas of Massachusetts:

- 38% of units placed in service between 1995 and 2003 are located in census tracts with over 30% of residents below the poverty rate (compared to 10% of all rental units)

- 47% of units are located in census tracts with over 50% minority population (compared to 16% all rental units)

In Low-Poverty Areas of Massachusetts:

- Only 15.8% of family units are in low-poverty census tracts

- Only 12.5% of family unites are in census tracts with minority percentages less than the large metro areas (19.4%)

In Boston:

- Only 13.6% of family units are in low-poverty census tracts

- 6.7% of family units are in tracts with minority percentage less than Boston metro area (20% minority)

Source: U.S. Department of Housing & Urban Development

How does the Low Income Housing Tax Credit work?

The program offers financial incentives for the development of low-income rental housing by providing significant reductions in federal income tax to investors who provide equity for affordable housing projects. The tax credits can be used for rehabilitation, new construction, or the acquisition of rehabilitated buildings. State agencies receive allocation of tax credits each year from the U.S. Treasury, which the agencies allocate to developers of rental housing reserved for households with incomes no greater than 60% of Area Median Income (AMI). Rent must not be greater than 30% of the 60% AMI. Unlike voucher programs, public housing, and section 8, LIHTC rents do not vary with the residents’ actual incomes.

How are Low Income Housing Tax Credits implemented?

Each state’s allocation agency develops a “Qualified Allocation Plan” that relates the use of the tax credits to the housing needs and priorities and controls for competition. In an effort to promote the construction of developments in lower-income communities, the federal government created a Qualified Census Tract bonus. Projects in “qualified census tracts” (more than 50% of households have incomes below 60%) AMI get a higher credit (up to 130%). Developments in Difficult Development Areas (DDAs), metro, and other areas with higher rents also receive a higher credit.

The result of these policies has been the segregation of LIHTC projects to low-income and minority segregated areas. Rather than focusing on areas of “high opportunity” with access to jobs, good schools, and lower crime rates, the LIHTC program has instead chosen income levels as their criteria of location preference. The LIHTC program has placed in service almost 145,000 units with two or more bedrooms in census tracts with poverty rates less than 10% between 1995 and 2003 — this is 22% of all LIHTC units built in metropolitan areas.

Measuring LIHTC

LITHC developments are included in the general federal mandate to affirmatively further fair housing and owners/managers cannot refuse tenants who use vouchers. There are no federal performance standards for the LIHTC program. In 2008, Congress through Housing Bill HR 321, has finally required the IRS and state HFAs to report racial and ethnic occupancy data in all LIHTC developments. Overall, the LIHTC program has funded the development of more than 1.5 million housing units. The LIHTC program has also been instrumental in increasing multi-family housing units, accounting for nearly 28% of all such units built since its inception.